Hi! I’m glad you’re here. You’ve made it to issue #80 of VC Demystified🪄.

My name’s Nicole - I’m a Principal at an early stage venture fund, and I know firsthand that VC can often be a black box. Breaking into the industry may feel daunting and resources can seem scarce and inaccessible. I wanted to put together a newsletter to give others the playbook I wish I had when I first started.

I’m doing a free panel with Hustle Fund Angel Squad on how to break into VC on November 13th!! RSVP: https://luma.com/2hyeeggr

Today’s deep dive: A data-backed look at how early-stage valuations form and why certain founders command better terms

My personal mission is to open as many doors as possible for other people and this newsletter is just one avenue to do that. As always, I will continue to post VC insights daily for free across my socials. This newsletter may contain paid partnerships or affiliate links.

VC Job Openings Preview (3 of 9)🪄

a16z is hiring a Consumer Investor.

Location: San Francisco

https://x.com/omooretweets/status/1982987607761211780?s=46

Pivotal Ventures is hiring an Interim Senior Analyst, Investments.

Location: Seattle, Washington, D.C., NYC, San Francisco

https://www.pivotal.com/careers?gh_jid=5670878004

Balderton is hiring an Investment Associate.

Location: London

https://balderton.notion.site/Balderton-Investment-Associate-Growth-Team-294110bf2d4a80efac64d661b4b93ee9

Read time: 5 minutes

A data-backed look at how early-stage valuations form and why certain founders command better terms

When founders ask how investors determine valuations at the early stage, they’re often expecting a formula.

At the seed and pre-seed stages, valuations are rarely about hard metrics like ARR. They’re anchored in ownership targets, raise amounts, and market norms (not discounted cash flows or comps).

It’s only at later stages, once a company has meaningful revenue, that valuations start to resemble public-market logic.

1. Early-Stage Valuation Is a Function of Raise Amount and Dilution

At the earliest stages, valuation is back-solved from the amount raised and the ownership investors expect.

Here’s the simple math:

Post-Money Valuation = Amount Raised ÷ % Ownership Sold

If a founder raises $2 million and investors want roughly 20% ownership, the implied post-money valuation is $10 million.

This “rule of thumb” approach dominates the market because it aligns with portfolio construction. VCs know that to reach optimal returns, they need a set level of ownership depending on the fund size (larger funds need more ownership). That target ownership drives how much they’re willing to pay and, by extension, your valuation.

2. The Data Behind It

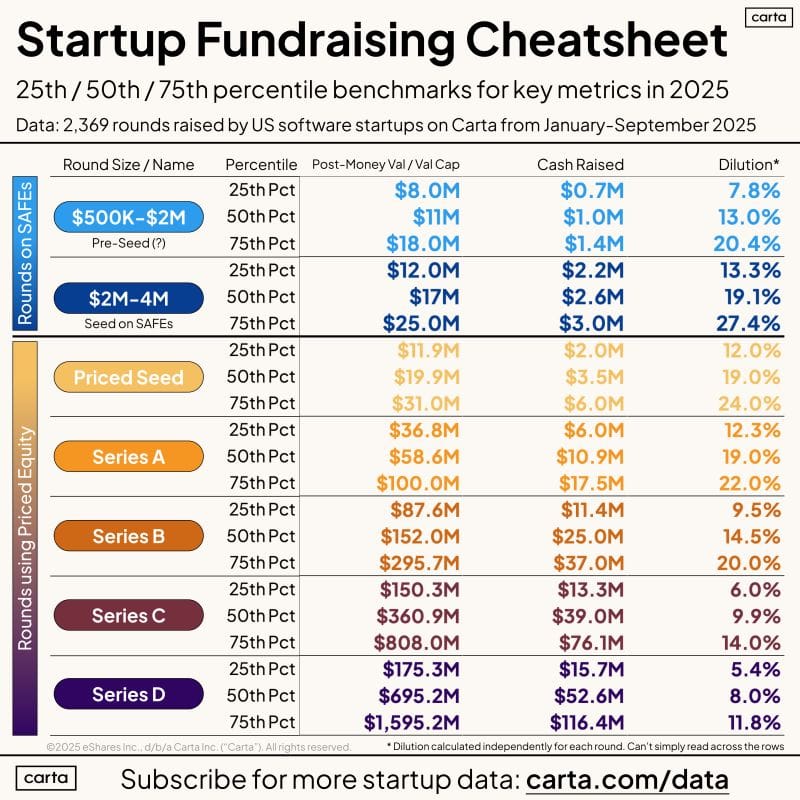

Carta’s latest 2025 dataset (2,369 rounds from U.S. software startups) gives a clear snapshot of how these norms translate in practice.

Across thousands of rounds, you can see a pattern: valuation scales roughly linearly with raise size because both are tethered to expected dilution bands.

At pre-seed and seed, investors tend to target 10–25 percent ownership. By Series A, it tightens to 15–20 percent. Later stages push even lower as rounds get larger and insiders double down.

3. What Drives Exceptions to the Rule

Of course, not every company fits the median. Founders can (and do) break these norms but usually for explainable reasons.

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade