Hi! I’m glad you’re here. You’ve made it to issue #70 of VC Demystified🪄.

My name’s Nicole - I’m a Principal at an early stage venture fund, and I know firsthand that VC can often be a black box. Breaking into the industry may feel daunting and resources can seem scarce and inaccessible. I wanted to put together a newsletter to give others the playbook I wish I had when I first started.

Today’s deep dive: Pro rata rights explained - the small term in a term sheet that makes a huge difference in fund returns.

My personal mission is to open as many doors as possible for other people and this newsletter is just one avenue to do that. As always, I will continue to post VC insights daily for free across my socials.

The future of AI customer service is at Pioneer

There’s only one place where CS leaders at the cutting edge will gather to explore the incredible opportunities presented by AI Agents: Pioneer.

Pioneer is a summit for AI customer service leaders to come together and discuss the trends and trajectory of AI and customer service. You’ll hear from innovators at Anthropic, Toast, Rocket Money, Boston Consulting Group, and more—plus a special guest keynote delivered by Gary Vaynerchuk.

You’ll also get the chance to meet the team behind Fin, the #1 AI Agent for customer service. The whole team will be on site, from Intercom’s PhD AI engineers, to product executives and leaders, and the solutions engineers deploying Fin in the market.

VC Job Openings Preview (3 of 10)🪄

a16z is hiring a Partner 20, Investor Ecosystem, Speedrun.

Location: San Francisco

https://a16z.com/about/jobs/?gh_jid=6656269003

Uncork Capital is hiring a Technical Associate.

Location: San Francisco

https://www.notion.so/uncorkcapital/Uncork-Capital-Technical-Associate-208003f7c32e8003a444c213cbe11117

Alix Ventures is hiring it’s 6th Venture Fellowship class.

Location: Remote

https://www.alix.vc/students

Read time: 3 minutes

Pro rata rights explained - the small term in a term sheet that makes a huge difference in fund returns

Pro rata rights are talked about constantly but never explained. They’re one of the most important terms in a term sheet and often the most valuable lever for investors over time.

Before we get started, be sure to check out my VC fund math newsletter issue to understand how VC exits / returns work.

Also check out this VC exit model excel template that you can download yourself.

What are Pro Rata Rights?

Definition: Pro rata rights (a.k.a. “proportionate rights”) give investors the option, not the obligation, to invest in future financing rounds to maintain their ownership percentage.

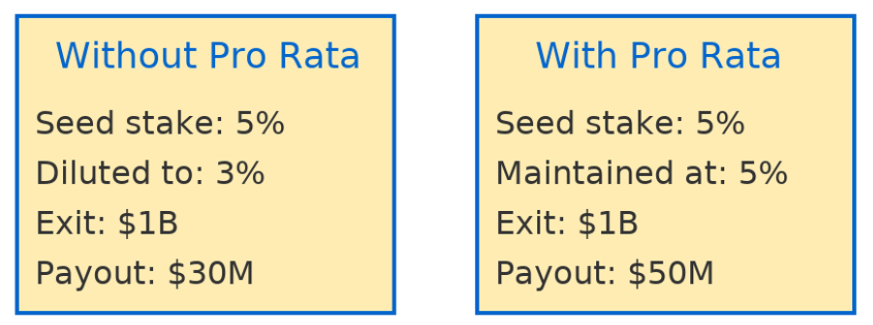

Example: If you own 5% of a startup at seed, and the company raises a Series A, pro rata rights allow you to invest again so you still own ~5% post-financing.

Why They Matter

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade