Hi! I’m glad you’re here. You’ve made it to issue #74 of VC Demystified🪄.

My name’s Nicole - I’m a Principal at an early stage venture fund, and I know firsthand that VC can often be a black box. Breaking into the industry may feel daunting and resources can seem scarce and inaccessible. I wanted to put together a newsletter to give others the playbook I wish I had when I first started.

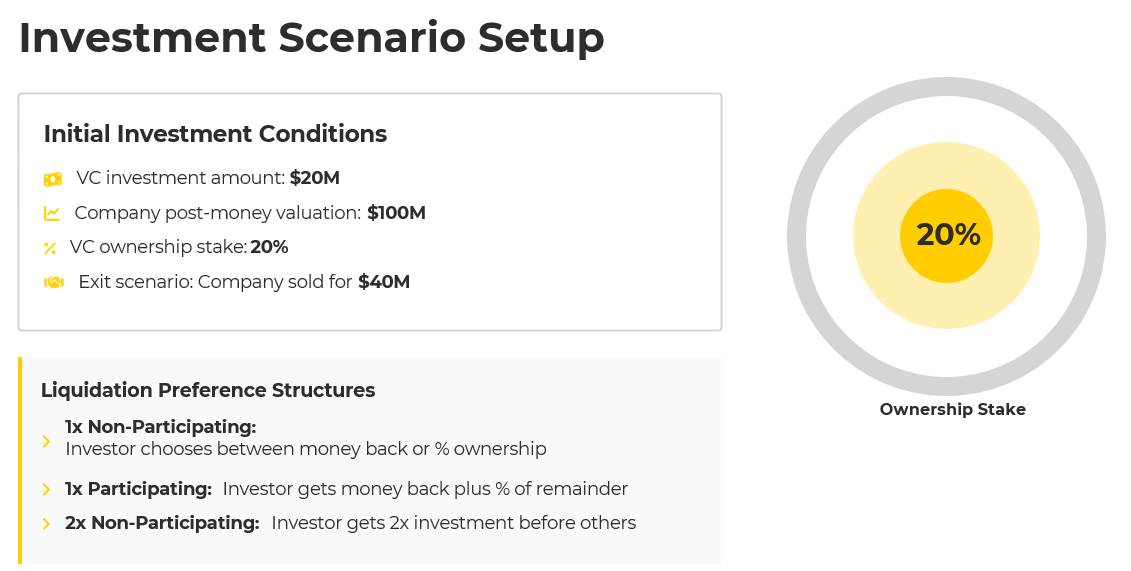

Today’s deep dive: A simple breakdown of liquidation preferences - the exit term that decides who actually gets paid and how much

My personal mission is to open as many doors as possible for other people and this newsletter is just one avenue to do that. As always, I will continue to post VC insights daily for free across my socials. This newsletter may contain paid partnerships or affiliate links.

VC Job Openings Preview (3 of 8)🪄

Harlem Capital is hiring Winter 2026 Interns.

Location: Remote

https://harlem.capital/internship/

Ridge Ventures is hiring an Associate.

Location: San Francisco

https://shorturl.at/jHXya

ChapterOne is hiring an Early-Stage Investor.

Location: San Francisco

https://docs.google.com/forms/d/e/1FAIpQLScxaQwwaVR4OiyvLWCeHHaGU3hdlYgezGX3gTkwPe35idgbQw/viewform

Read time: 5 minutes

A simple breakdown of liquidation preferences - the exit term that decides who actually gets paid and how much

When founders negotiate a term sheet, valuation usually takes the spotlight. But hidden in the fine print is a clause that often matters more in determining who actually gets paid in an exit: liquidation preferences.

Investors call them “downside protection.” Founders sometimes call them “the silent killer.” Both are right.

Let’s break down what liquidation preferences are, the different forms they take, how they impact payout math, and what they mean for both founders and investors.

What Are Liquidation Preferences?

Liquidation preferences set the rules for who gets paid first (and how much) when a company exits, whether through acquisition, IPO, or even bankruptcy.

Preferred shareholders (investors) almost always sit ahead of common shareholders (founders and employees). This was originally designed to protect investors in the event of a smaller-than-expected outcome.

In practice, it can heavily skew who actually takes home money at exit.

Types of Liquidation Preferences

Not all preferences are the same. Here are the most common:

1x Non-Participating (Standard, Founder-Friendly)

Investors get back their original investment or convert to common stock, whichever is more valuable.Participating (a.k.a. “Double Dip”)

Investors get their investment back and then share in the remaining proceeds pro rata with common shareholders.Multiples (2x, 3x, etc.)

Investors receive 2-3x their investment before common sees anything. These were more common in frothy markets and are generally very investor-friendly.

A Simple Math Example

Let’s say a VC invests $20M at a $100M valuation for 20% ownership. Later, the company sells for $40M.

Let’s do the math to see how much the investors get back and how much the founders/employees get back in each liquidation preference structure:

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Upgrade